The article below is from the website of QCFC an advocacy group based in the Philippines for change and reduction of graft and corruption. It is a lament over the lack of sensitivity of the banking sector in the Philippines to the needs of enterprise.

Inevitably, a major revamp, or policy regime change is needed in the banking system in the Philippines as admonished in the site called www.qualitychange.org. There is hardly any more time to waste. The economies of Asia have undergone major upheavals, yet the Philippine economy is still in severe doldrums. The government does not have the political will to spur change, with its penchant for stealing taxpayers' money for personal aggrandizement.

Politicians maximally utilize persons like Ms. Janet Napoles who divert Philippine peso skims to the United States in suitcases without fear of the Anti-Money Laundering laws, Mr. Zaldy Co (who even ran for Congress himself and won), and many other fund fixers later masquerading as filthy rich financiers (outside of the Forbes List) to steal billions of money from the national treasury.

Much of the thievery is done through the pork barrel - discretionary public funds that are hardly accounted and form part of political accommodations, horse trading between the Executive branch and the Legislative, including the Judiciary.

With a public sector motivated by greed and wanton plunder of the national coffers often with the quiet collusion of members of the banking sector, there is absolutely no way for the government to censure and reform the banking industry simply because it has no moral ascendancy at all.

The Philippine President, Mr. Benigno Simeon Cojuangco Aquino 3rd, does not want the pork barrel to be abolished, as evidenced by his own recent statement over national media in defense of the Disbursement Acceleration Program (DAP) that is a creative new name for pork barrel. Mr. Aquino the 3rd is adamant that he announced the DAP two years ago. Therefore, since the 3rd made a public disclosure of this benign, saintly kind of pork barrel, the spending thereof has to really be just and fair but only for all the horrible looking money making ogres concerned, the 3rd not excluded.

There is nothing in this sanitized, beatified, canonized pork barrel for the small entrepreneurs who need money for developmental projects.

Any intervention that must be done to change the way things are being done in the banking system will be initiated by the citizenry as well as well meaning members of the private sector. The issue is not all about simple patriotism, love for country, but the obligation of the creatures sitting in comfortable niches to return to their host country a share of what they have amassed over the years and decades of siphoning the hard earned money of ordinary people in whose names the Philippine bonds and treasury bills are created, among other debentures that average citizens of the Republic are bound to pay for during their maturity.

No banker will not acknowledge this fact, but they close their eyes due to their all-consuming greed and insatiable lust for more and more money, without looking back to where they came from and who are the source of the incomes they derived from their very expert manipulation of currencies, notes, bonds, bills and all the shit in banking.

Philippines: Every average businessman in this country has to go through the eye of a needle to be accommodated by the banks. Businessman Mr. G. Go, actively engaged in small scale financial services for both big and small entrepreneurs says:"There is an exception. You can always borrow big amounts from banks but you have to have pedigree. If you don't have pedigree forget about borrowing big even from the biggest banks. They won't even look at your loan application. How stupid is that?"That about translates to this: Bankers look at clients as dogs, cats and cows. Those with pedigree are instantly good clients. and must be given service de luxe and with haste. Those without are immediately considered bad clients and cannot be serviced for big transactions ever.

In Masinag, an officer of RCBC Savings Bank, Ubaldo Sadiarin would go out of his way to offer something to drink to all his visiting customers. Mr. Sadiarin cannot look at his clients as animals, since animals normally don't take coffee, black, with or without sugar or milk. This banker does not only offer coffee, tea or juice. He painstakingly helps you obtain your loan and helps you be able to access the money at the fastest possible time. The fellow must not be the ordinary, brain damaged banker. However, this trait of said banker should not impel his own banking institution to think ill of him. In fact this bank manager should be pirated by the Department of Finance or the Bangko Sentral ng Pilipinas.

Bangko Sentral ng PilipinasExcept for Maybank Philippines, very few banks through their run-of-the-mill branch managers, mid-level officers and workers will even offer you water, juice or coffee. How much more a big loan?

Among the brainless, idiotic and impractical policies of banks is imposing quota performance on their bank managers. Whereas there is very meager creativeness among many top bank management officials in promoting their respective bank product brands, to attract clientele, this strict policy of quota is ruthlessly rammed upon the throats of the helpless bank managers and all the bank workers below these managers.

This leads to the great inadequacy of the banking system in pump priming of the economy through the promotion of brisk and dynamic exchanges between and among local business as well as with the rest of the world.

Such a noteworthy posture could be done by not limiting the distribution of the bulk of bank investments, credit, to billionaires like Andrew Tan, Henry Sy, Lucio Tan, Jaime Ayala, Eduardo Cojuangco, Eugenio Lopez, Ramon Ang, Washington SyCip, John Gokongwei, or big time criminal thieves like Janet Lim Napoles, Zaldy Co, jueteng collectors Yolanda Ricafort, Tony Santos, notorious drug dealers like the Lim clan of Malabon-Navotas of the Chinese Triad, Li Lan Yan aka Jackson Dy, Li Tan Hua, Hanson Young (ordered killed by his Chinese Godfather Mr. Stephen Hui while in police detention) among many other dregs of society.

Preferred clients therefore are billionaires, criminals, jueteng collectors, drug lords - not necessarily in that order. Certainly, there are Senators, Senate fixers, Congressmen, Batasan complex arrangers, Governors and their Vice, Mayors and Vice, Board Members, Barangay Chairmen and Boards, appointed officials among a few other money grubbing species.

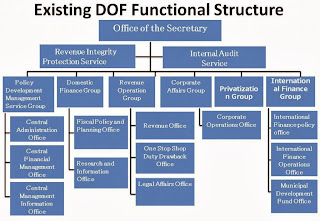

Gallery of favored bank clientele:Philippine BillionairesCharing Magbuhos, and some from drug lords shown belowDrug Lord Li Lan Yan aka Jackson DyDrug Lord Li Tan Hua, son of a Chinese GeneralMost certainly, there is no need to justify the extremely laughable overriding need to meet headquarter's quota for each and every bank branch manager to merely accommodate deposits, loan applications and other bank requirements from big businessmen and criminals alike at the expense of allowing the majority of transactions in the country to proceed with a positive momentum and spur the economy onwards.The all-consuming greed of bank founder-owners has given birth to the cross-eyed policies constricting the Philippine banking system. This kind of pernicious culture has even pervaded onto the rural banks and thus created misery after misery from the metropolis to the countrysides.Therefore, instead of promoting business and helping entrepreneurs to shine, the Philippine banking community has an invisible declaration of war against any businessman who registers his or her enterprise - if and when that hapless creature does not have the pedigree of billionaires, drug lords, jueteng lords, big time thieves of government taxes, among many other obnoxious animals. The big question is why the Philippines' Department of Finance, Bangko Sentral ng Pilipinas and the entire economic cluster of the public sector as a whole, would not lift a finger to change this kind of situation.Whatever functions the Department of Finance assigns to its officers, it is admonished that before the Philippines slides down to the lowest ranking in world economies or the country experiences more and more difficulties with the onslaught of unnatural occurrences like shortages and devastations from disasters like the Boholindol - Cebulindol, gestures with a semblance of bringing reforms to the banking sector should be started as soon as possible.No self-respecting public sector finance agency in the age of the AMLA should allow this lopsided situation where only billionaires, drug lords, gambling lords and thieves are given preferential treatment. The time for best banking sector practices should be put in place is long overdue. While it is not quaint to say the planet, the entire globe is too unstable for the country to expect to survive the next few hundred years, the worst that could happen without reforming the unfair practice of bankers in the Philippines is for the country to perpetually be a supply economy.

As it is, even our human resource is being supplied all over the world and very few complain.

There is no rice to export, no trees and forests to log over, little trickles of gold to mine with the banks benefiting from all the harvest without giving back good banking service to their host: the people of the Philippines. That includes the entrepreneurs within the population.

The credit cards Metro Bank and foreign credit institution VISA, (e.g. Unionbank Prepaid Visa, BPI Prepaid, PNB Prepaid, PSBank Prepaid, Security Bank Prepaid among many others) promotes credit that is already prepaid before you spend a cent for purchases.

A large number of law firms and collection agencies all over the country have benefited up to 45% commissions share for recovering long lost debts for credit card companies and banks.

The question is, when all over the world especially in the US Army, people start shying away from using credit cards because it buries one in serious perpetuating debt burdens, more if you are not scion or heir to the tycoons in Forbes' List, Philippine banks are obsessed with selling that product: the plastic money.

And 99% of members of the Bankers' Association of the Philippines are racing against each other in selling insurance and pension plans without letting the entrepreneur class to succeed. These locos must have lard as brains.

Why can't the Philippines' bankers offer various products, differing types of credit and pretend their bank managers understand how to use the SWIFT transmission, letters of credit, bank guarantees, term notes, and all other kinds of debentures without concentrating only on the Philippine Government as creditor?

Banks buy and buy treasury bills, government bonds and rediscount the bills and bonds at a fat profit but they cannot lend back with a smile to the people of this country.

The Philippine banking system cannot perpetuate this kind of situation where the only valued customers are the rich, the close friends and relations of bankers, lumped together with the drug lords, public fund thieves (Janet Napoles, Zaldy Co, et al), jueteng lords and other criminals.

This is not a country only of billionaires, millionaires, friends and bankers' close relations as well as the shit, waste and rejects of society such as heinous criminals. This is a country of nearly 100,000,000 Filipinos with millions of enterprising ones engaged in business in both the formal and informal economies of scale.

Colombia and Mexico of the famous illegal drugs, Switzerland, Singapore, Hongkong and the Caymans, among a few other havens of those with money that are mostly dirty and stained with the blood of millions, may be thriving from accommodation of unclean funds but the banking communities in these places do not necessarily just favor the Sys, Tans Ayalas, and their ilk, or their counter parts in the Underworld. They service legitimate businessmen more than the Philippine banking system does and do help their economies to grow, one way or another.

Thus there must be loose screws somewhere in the brains of the owner-founders of our local banks for they cannot foresee a Philippines with a thriving entrepreneur class, vibrant and alive, competing with the rest of the world while offering Filipino-style world class products and services.

As the website www.qualitychange.org declares:

Policy regime change is needed in the business and especially in the finance sector. The old paradigm of the Philippines and selected vassal type states with supplier economies, must be revolutionized. This will depend mostly on the act of the young, emerging, up-and-coming captains of industry.

The history of Philippine finance has been that of subservience and excessive docility towards superior super powers or stronger industrial economies. This cannot be the case any longer. Even with the excursion of individuals or groups like Enrique Razon to foreign frontiers, Ayala and other entrepreneurs - Eduardo Cojuangco Jr., Lucio Tan, Henry Sy, John Gokongwei to foreign enterprise destinations or missionary ports such as New Zealand, Australia, China, Latin America, Papua New Guinea, Vietnam, among many others, much has to be repaired in the Philippines.

Benevolent jump-starting credit from both the public and the private sector is close to non-existent, breeding unsophisticated but widespread corruption within the private sector; the government is most of all helpless to stem this kind of graft and corruption within the world of Philippine business. The doctrine of trust as the most important item for purchase in the Philippines is extremely prostituted to nauseating proportions. At the end of the day, private enterprise becomes the receiving end of chastisement and censure for entering into haphazardly concocted schemes that bleed the public treasury dry or siphon the blood of the average consumer publics.

While banks deprive the vast majority of the country of credit, the financial sector lends indiscriminately to public sector institutions that simply steal the borrowed funds or connive with private business groups or ghost, or shell non-profit service providers to divert the loans and bank the same in private accounts.

The simple equation in this situation ultimately involves government and the people. If small entrepreneurs decide to boycott the entire Philippine banking sector, there will be a small dent on the earnings of the sector. With the interlinked interests of those at the top levels of government and the banking system, the public sector cannot give up easily on its support for the banking industry. But a compassionate government will at least admonish the bankers that a sufficiently acceptable new tack should be taken to uplift the economy much, much higher than its present peak performance.

Something has to give and it has to be soon. The Philippine government must become more responsive to the needs of the entrepreneurs of this country so that revenues coming therefrom will improve. And show a little more compassion to its constituents instead of completely being devoid of it for the sake of mindless smoke belching and skirt chasing.

When the floodgates open sometime soon enough, it will be difficult to stem the tide.

As it is, natural phenomena have wrought untold disasters in this nation of beautiful and hospitable people. Together with man-made disaster, bankers will have no safe place to turn to. Furthermore, no banker can take his money or his safety vault to the grave, unless his resting place in his hole six feet below the ground is spacious enough to accommodate his riches.

Then again, the so-so practical-minded bankers will simply fart and twit the question: So if I'm dead, who cares? I lived a great Life fully as a Banker and I am happy. If I go, I go. That's how it is. Then Mr. and Ms. Banker excretes just a teeny weeny little sweat and a foul sigh, and its over for the worry.

If all Philippine Bankers are like that, do you really have to place your trust therein ever if they treat you like shit and wouldn't change their view towards you unless you joined the league of Forbes Lists and the Underworld?

Related articles:Assessment of the problems of the Philippine financial sector

Issues and challenges facing the banking sector

0 comments :

Post a Comment